Intro

One idea discussed, was the need for stepwise continuums to find success in bioprinted innovation. This would be where many advancements can find fruition, and also where most funding investors would find comfort given the investment time horizons are within the 10-year window or less. This is particularly relevant with medical device implants.

There is a group of companies, some more noticed, some less, who are attempting ways to create longer investment, time horizons. Whether by funding themselves solely on grant funding from the government, going public, working with investors who have funds to go past the 10-year mark, or being in countries where investors are more comfortable to see investments go longer. This group is doing much higher risk for higher reward work. And whether successful or not, there work is important to watch to see what goes well and what doesn’t so we can all learn from it.

The specific reason for the significantly increase risk is because they are attempting to incorporate cells into the final printed product. To be clear, they are printing cells in a specific geometry with biomaterials. Or they are printing biomaterials and then adding cells outside the OR room after to make a product. Whether the former or later, the incorporation of the cells makes these products theoretically perform better. It does also though make them much more difficult to bring to market. An interesting aside here, in industrial settings we speak of bioprinting companies as any that print biomaterials, whether with cells or out. In academic settings, most definitions would include printers, biomaterials, and cells…and that definition is what concerns us today.

Pushing the bounds

To start, we have seen many failures of regenerative medicine companies in the past that have desired to incorporate cells into their products and carved paths to bring these products to market, only to find the product not viable to sustain the company or the investment. Two clear examples are Advanced Tissue Solutions and even the currently existing Organogenesis.

Advanced Tissue Solutions(ATS) was a company that was co-founded by Gail Naughton, setting out initially to make artificial skin by growing human allogenic foreskin, aka other people’s cells, and placing that on biomaterials to create a potentially more cost-effective solution for diabetic foot ulcers. It was essentially, better at regenerating skin than the alternative. As described in Nitin Pangarkars article on the ATSs case study, the financial projections were exciting with $37 million in sales the first year with growth of up to $127 million per year. The cost at the time for treating diabetic foot ulcers were $30k-$65k, and ATS’ Dermagraft was projected to cost a total of $4k, a big leap in cost-savings.

While the company had great financial projections, there were a host of challenge from strategic focus, FDA approval retrial, and the difficulty to keep raising funds to keep operations open. It’s interesting to speculate on the decisions that management took as a part of the fall ATS. While there is some truth to that, Organogenesis a similar company with a similar proposition, in which the article also mentions being more managerially sound, also filed for bankruptcy the same year. So, two similar companies with similar product, different managements and the same markets both filed for Chapter 11. This leads to believe that it might have to do more with the types of products their business models were driving, rather than the company dynamics or organizations they had.

It’s interesting to note around that same year, 2002, Integra Life Sciences, today a very successful business, brought to market with FDA approval the use of Integra Dermal Regeneration Template for reconstructive surgery of burn scars. A similar idea, heal the skin, only much more successful at the time. The reason for their success at the time? The product is acellular, aka no cells. The inner layer is made of biomaterial to promote inner layers of the skin to heal after a burn, the 2nd layer is silicone which helps protect the graft from infection and hold it intact. In 2015, Integra acquired Primatrix, a dermal repair scaffold product to treat diabetic foot ulcers. That also doesn’t have any cells.

It is also good to note here, that many investors tend to shy away from regenerative medicine companies given the complexity of tissue engineered products. While that is true with products that have cells, Integra, is still a regenerative medicine company, used a biomaterial product without cells, and it has had tremendous success.

The reality is, the infrastructure to be able to ship, sterilize, package, and store biomaterial-based products exists and individuals are well aware of it. The infrastructure to do the same with a living product containing cells is much more difficult. It’s the cells, their delicacy of handling, the time limits based around when the product is made to when it can be used that has an influence to add in complexity not only to the success of the product, but the business model as well. Last and certainly not least the ability to pass the regulatory hurdles is also hire.

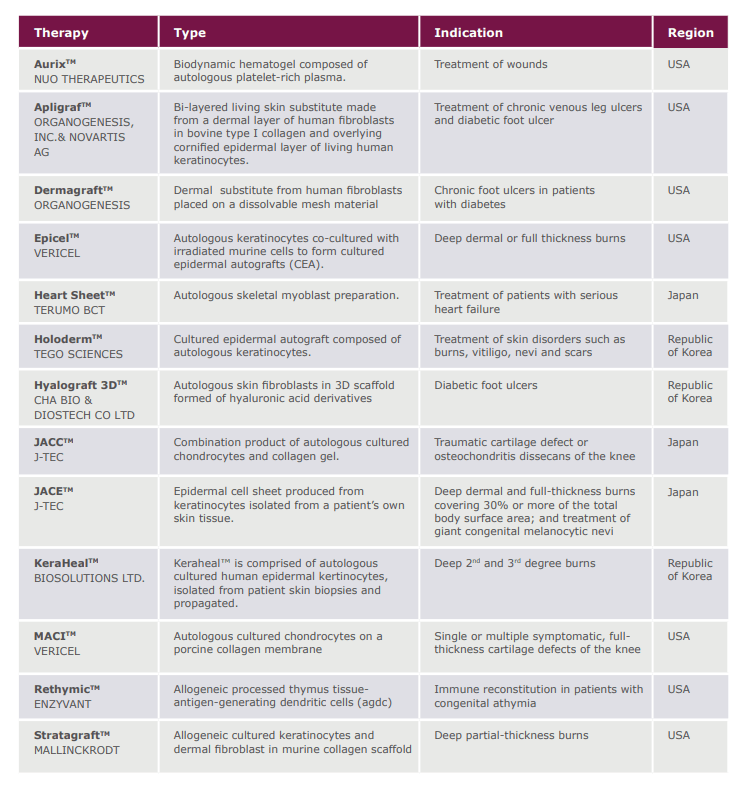

While ATS, didn’t reignite to see another day, Organogenesis, after a few transactional deals, revived and lives today, ironically enough with the assets of ATS(Dermagraft) inside of it as well. Organogenesis is one of handful of companies that ships products with living cells. The Alliance for Regenerative Medicine created a recent white paper that lists the majority of companies’ products with cells being approved are to regenerate skin or cartilage. (List below)

The take away

So, what shift do we need to watch to see more companies be developed with more success? It’s the infrastructure that is being developed in the world today to coordinate the harvesting, scaleup, and delivery of cells. As well also help streamline the regulatory hurdles to bring a product to market, similarly to how we have seen in biomaterials. One point that is hopeful is that the cell-therapy movement for immunotherapies is particularly spearheading the groundwork for tissue engineered product with cells to grow off of. The thinking is companies like Cellarus or GeneFab. They are making the cells phones so the apps can be made on top of.

Now that we have a foundation in all the above, where does that leave some of the companies that are pushing the bounds of what’s possible in terms of incorporating cells into products. Just as a preamble, they are companies like Aspect, Satellite Bio, and Miromatrix. That will be the focus next time.

Until then,

Leave a comment