A great place to a apply personalization from macro architecture is breast implants for women who have had to receive a mastectomy. Breast cancer is a growing challenge in the world as it is the most common cancer among women globally, with about 2.3 million new cases diagnosed in 2020, according to the World Health Organization (WHO). This high incidence rate directly influences the number of mastectomies performed. The number According to the American Society of Plastic Surgeons (ASPS), in 2020, was about 137,808 breast reconstruction procedures following mastectomies, highlighting the prevalence of mastectomies themselves.

It’s interesting to note that the solution for a mastectomy reconstruction on a single breast almost requires the need for a personalization solution. While enhancing a breast, the proportional increase would be applied bilaterally, on both sides, and could be done using off the shelf components: small, medium, or large. Therefore, the procedural outcome would most always have the effect of looking natural. This is different though in the scenario for breast reconstruction because the size of breast should closely match the other side to be able to achieve as natural an outcome as possible. The proportional shape and size matters to be able to achieve a natural result.

The solutions to date

The therapies to date have mostly involved 3 types we will over view them quickly.

60-70% of all therapies for breast reconstruction use synthetic implant-based therapies. It’s the most tried and true and simplest therapy. The draw back here is the potential for the implant to rupture, implant may need to be replaced, and patient’s body might have more of a reaction against the implant. Those two types are:

Silicone Implants: Filled with a silicone gel that mimics the feel of natural breast tissue. They are the most popular choice for both augmentation and reconstruction.

Saline Implants: Filled with sterile salt water. They can be adjusted in size during surgery and have a firmer feel compared to silicone implants.

30-40% of all breast reconstruction use autologous tissue reconstruction. It results in a more natural solution, yet is more complicated to achieve usually requiring several surgeries and potentially worse morbidity if tissue is taken from other parts of the body. This type is:

Autologous Tissue Reconstruction: Uses the patient’s own tissue from another part of the body (such as the abdomen or back) to reconstruct the breast.

The Key Incumbent Players

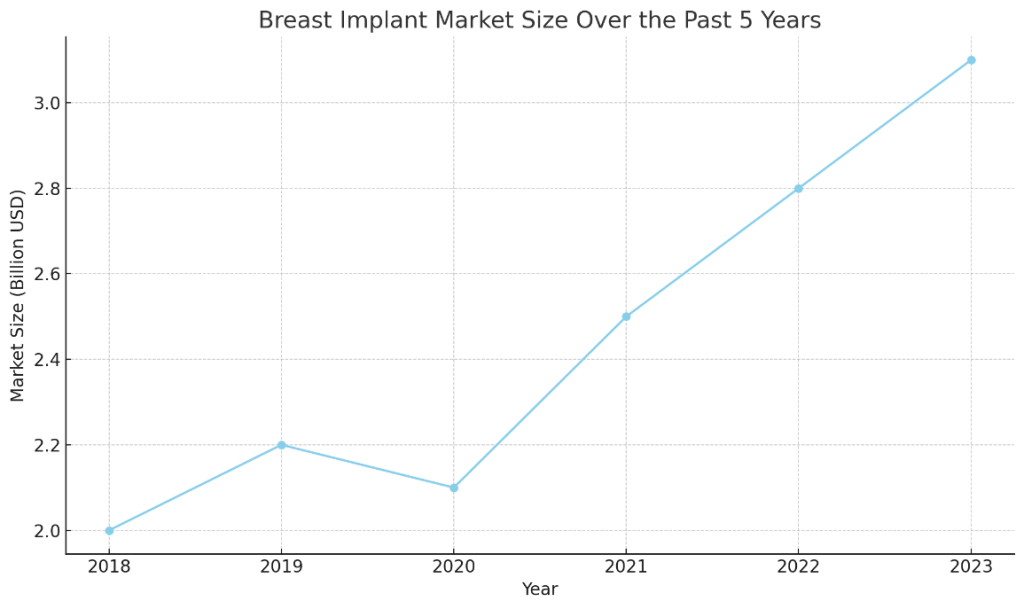

As we look at the market, total around $3B, with a ~10& CAGR,

Fig 1. Generalized market growth over the past 5 years.

it is mostly concentrated around a few key players:

Allergan (AbbVie) (~$800 million) -known for its Natrelle line of implants, is a leading player in the market. Despite the recall of its BIOCELL textured implants in 2019, Allergan continues to innovate and maintains a significant market presence.

Mentor Worldwide LLC (Johnson & Johnson)(~$950 million) – Mentor, another major player, is renowned for its MemoryGel and MemoryShape implants. Mentor’s comprehensive warranty program and extensive clinical studies support their market position.

Establishment Labs (~$167 million) – Known for its Motiva implants, Establishment Labs is another key player focusing on innovative and safe breast implant solutions.

The potential enhancement of 3D printed silicone

If we review and think about companies who are attempting to innovate in this space using 3D printing, we find very quickly companies using a bioresorbable material to try and get fat cells to regrow and then have the material resorb back into the body after the fat has grown. This is certainly innovative yet a further step removed then what we discuss in the stepwise continuum. The logical next step would be to take one of the silicone materials above and rather than being molded to rather being 3D printed. This would allow for the ability to print on demand breast reconstruction sites with a more direct path to market proving out the business case for custom made breast implants, particularly for patients who need a unilateral replacement. This would also allow for a more direct 510k approach to bring the device to market vs a PMA. For example, there is:

Mentor MemoryGel – Mentor Worldwide LLC uses a proprietary cohesive gel that provides a natural feel and appearance. Their implants are designed to offer both firmness and softness.

Allergan Natrelle – Allergan’s implants also use a cohesive silicone gel, known for its durability and natural feel. The Natrelle® line includes various shapes and sizes to cater to different patient needs.

Patterning these gels into forms that are personalized would be a natural progressional evolution to applying 3D printing in a useful way. Whether extruding them or printing them with valuable infill pattern using 3D printing. It would also potentially allow the breast to have more form and shape than would otherwise be possible with standard molds.

The companies taking a stepwise approach

There a few companies who are attempting taking silicones and 3D printing them.

The first is Pricsima who has developed a system that has similarities to a company called Rapid Liquid Print, RLP, (of whose technology I think is better). Pricisma is taking silicone and printing material into a bath to be able to create objects. Hard to say if Pricisma still exists since not much progress can be seen from them since 2017. Nonetheless the idea they had was a good one, as long as resolution of their prints can be high enough. RLP’s prints though for certain look really great and be able to take one of the above materials along with RLP’s technology would be a very good avenue for innovation and impact. Particularly if they could take the 510k route for the technology.

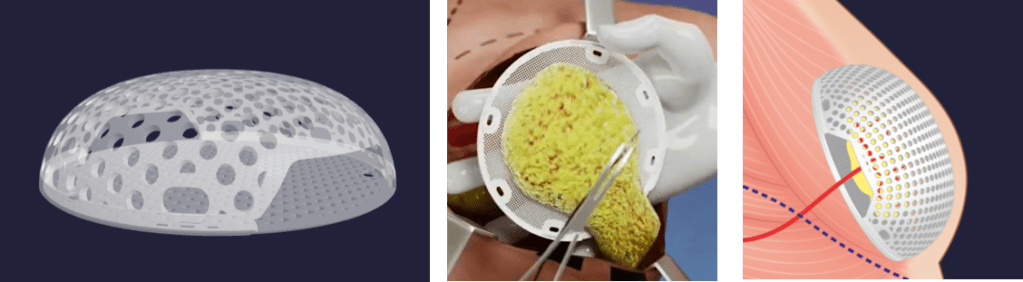

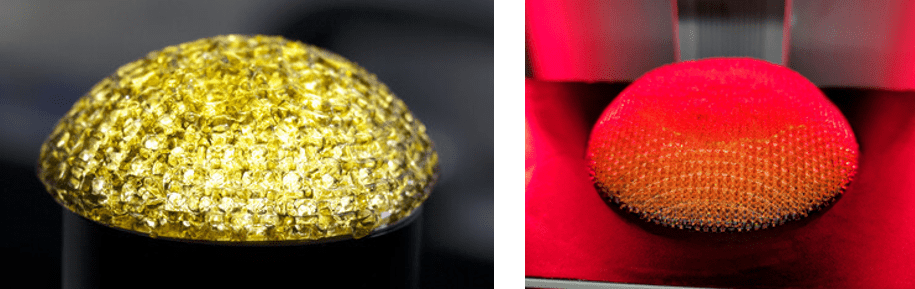

The second company is Prayasta from Bengaluru, India founded by Vikas Garg, which is great to see how a company in this part of the world can be one of the leaders in 3D printing by continuing to push the bounds on a specific application. Prayasta implants are completely made of 3D printed silicone and go on to state that value create from implants are not only from the personalized marco shape, yet also from the ability to change the lattice architecture on the inside to be able to adapt the weight and feel of the implant. This is an interesting thought because these is a potential to make 3D printed breast that are able to become more resilient, potentially improve feel, and vary weight by lattice internal architecture. This then allows the possibility to produce not only for breast reconstruction, yet also for breast augmentation, given that the only way to make the lattice structures would be through 3D printing. Prayasta has a patent that has pretty broad claims and something to be looked out for. It will be interesting to see how Prayasta uses this patent moving forward particularly in the U.S. as well as to how it will hold up if other competitors create similar products and challenge the patent.

Fig 2. Prayasta 3D printed silicone breast implant.

Companies creating a paradigm shift in the way breast implants are made

While the natural progression of innovation is taking approved silicone and using 3D printing to allow for personalization and lattice customization, the ideal would be to have the patient regenerate a breast of the patient’s own cells, whether fat or duck cells. The ideal of having a fully natural breast would allow the patient to not worry about replacing the implant, about rejection, or understanding the right weight and feel.

There have been a few companies in the space who have been working towards that goal and they have certainly made some headlines.

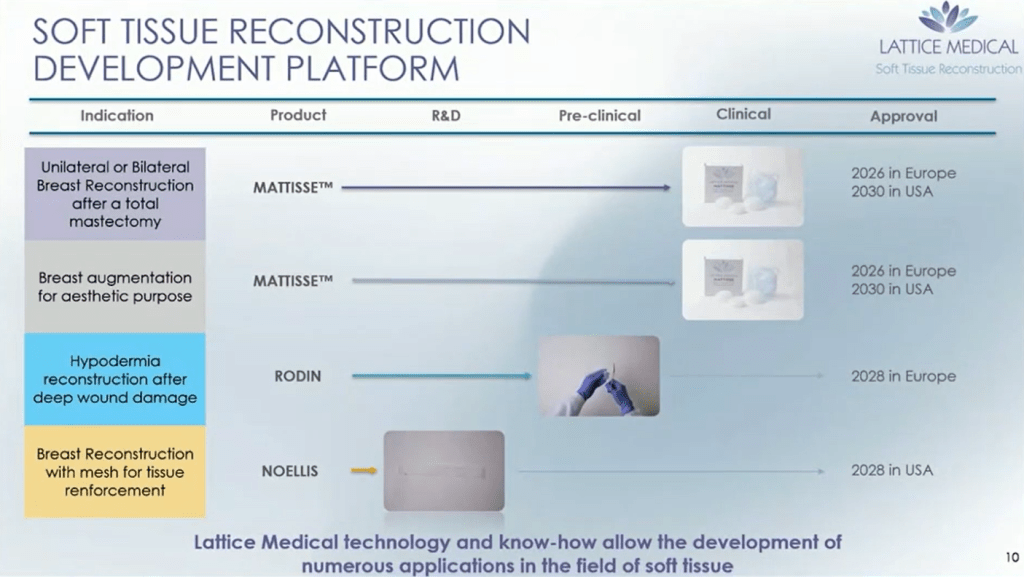

The first company is Lattice Medical. Lattice Medical is a French biomedical company based in Loos, France, specializing in innovative tissue engineering, biomaterials, and 3D printing technologies. Founded in 2017, the company aims to revolutionize reconstructive surgery, particularly in the field of breast reconstruction, through advanced medical devices that promote natural tissue regeneration.

Their product Matise is made out of a PGA formulation PURASORB, who is from the company Corbion.(Publication) Matise is a 3D printed a-cellular biodegradable shell formed to the patient’s size. It’s interesting to see how Lattice is not producing their own materials but rather taking off the shelf implant grade ones to form solution to medical applications in need of solutions. Mattise is printed in a way that the patient’s own fat cells can be surgically placed inside in one operation. ~100c of autologous fat is harvested just below the breast and placed inside the 3D printed PGA construct. (Video is here)

Fig 3: (left) mattise bioprinted construct, (central) autologous tissue harvested, (right) implanted construct with harvested tissue.

They have patents pending on this technology(one, two), have raised $20M to date, and are currently working to get a CE mark in Europe for the implants by 2026 in Europe.

Fig 4: Lattice Medical Pipeline Timeline

From viewing their plans, they have also expanded their product offering to include meshes for both hypodermia repair(Rodin – associated publication), which is made from Evonik PLCL Resomer polymer, as well as using a sheet mesh specifically for breast reconstruction(Noellis) potentially made from the same material. Both product offerings, , RODIN and NOELLIS, provide value through a beneficial microarchitecture to enhance regeneration and control degradation to expand their portfolio to other applications.

Lattice Medical has many aspects going for it, in the sense they are focusing on mostly a specific niche in breast reconstruction, are outsourcing their polymer creation, a partnership to produce their implant with Cousin Surgery, and have focused on bringing to market a solution to an unmet need using a synthetic scalable polymer. What remains to be seen is their success commercially, particularly in Europe which is where their main focus should stay as they attempt to be successful rather than branching out to the US market to quickly to preserve their cash runway.

A second company in the race for breast regeneration is Collplant. CollPlant, based in Rehovot, Israel, founded in 2004, focuses on developing innovative products using its proprietary recombinant human collagen (rhCollagen) produced through plant-based genetic engineering. The company has literally taken human collagen DNA and modified it into tobacco plants so instead of the plant making tobacco it makes human collagen. Let that sink in for a second, from farm to human. They harvest human collagen from these plants that grow on fields. Think of human collagen as the new tobacco. Professor Oded Shoseyov in Israel, figured out a way to genetically modify plants and has been introducing genes to produce a number of different proteins including alpha 1 and alpha 2 collagen chain. The specific patent to introduce collagen into plants can be found here, with an expiration date of 2026.

Collplant has evolved to be strategic as to how they are developing their medical device portfolio. They first launched Vergenix: series of products, including VergenixSTR for the treatment of tendinopathy and VergenixFG for wound healing applications

Fig 5: (Left) VergenixSTR for treatment of tendinopathy (Right) VergenixFG for wound healing application

While the above products didn’t take off, the follow up products for dermal fillers and breast reconstruction have more exciting potential. Collplant announced a commercialization agreement with Allergan Asthetics, for its rhCollagen in dermal and soft tissue filler products. It’s a great strategy to begin in this direction given that this is a stepping stone on their path to their initial greater ultimate aim of printing breast implants for breast reconstruction. They use in-situ photocuring for this specific strategy. With a video that describes their filler here.

Fig 6: Collplant photocurable dermal filler.

As we’ve discussed above Allergan also makes Natrelle breast implants, which is the #1 selected brand in the U.S.. By working to establish a relationship with Allergan in dermal fillers, it would be a natural transition for Collplant to commercialize their breast implants with Allergan. They are currently working on pre-clinical trials with commercial-size, regenerative breast implants. And are collaborating with Stratasys to produce their bioprinted implants.

Fig 7: Collplany bioprinted breast printed of a Stratasys printer

The approach that Collplant is taking is an exciting one. They are taking a stepwise path, first with injection then to filler, then to printed product to derisk and build a relationship with a commercial partner. They are also taking an approach where the patient doesn’t need to provide any autologous tissue, rather relying on the body to infiltrate the scaffold, regrow into it, and degrade it overtime. It will be interesting to monitor two things, the first is how do the preclinical trial results look on the commercial scale models. What tissue for example is growing into the scaffold? The second that continues to play a key role, is can Collplant scale? They need land, and to increase their farming threshold. While their patent to reengineer plants is coming off patent soon, they do have a good runway with their dermal filler patent and 3D printed recombinant collagen patent.

Conclusion

While the market continues to hum forward providing silicone breast implants, where will the innovation come from? Picsima, Lattice, and Collplant are all interesting players to watch and learn from. The natural evolution would be for one of the top 3 breast implants manufactures to begin to add in new architecture using 3D printing to find value, yet Collplants direction of first making dermal fillers is an interesting one to then pivot on to breast implants. The commercial deal with Allergan by Collplant is a good market derisking move. Lattice, Picsima or another company should potentially follow suit with another top-3 player. There are other companies like Bellaseno or projects like ReConstruct from the Wyss Institute. The above though are believed to be some of the most exciting, relevant, and commercial feasibly close options to a product to make it to market.

___________________________________________________________________

Forward Looking Statements

The views and opinions expressed are based on current information available and are subject to change. This site contains forward-looking statements that involve risks and uncertainties, which may cause actual results to differ materially from those expressed or implied by such forward-looking statements. Readers are encouraged to do their own research and consult with a qualified financial advisor before making any investment decisions. The author does not assume any liability for losses incurred by readers.

Leave a comment