Vericel (NASDAQ:VCEL) has established itself as a key player in regenerative medicine, yet the market continues to undervalue its potential. Unlike biotech firms chasing high-risk blockbuster drug approvals, Vericel has built a solid foundation with FDA-approved products—MACI, Epicel, and NexoBrid—delivering steady revenue growth and strong financials. With a notable 16% year-over-year revenue increase and zero debt, Vericel is positioned for scalable expansion. The company’s recent push into ankle cartilage repair with MACI could be a transformative step, expanding its addressable market and bolstering long-term profitability.

Financial Strength and Growth Trajectory

Vericel reported $167 million in cash and investments as of 2024, maintaining a debt-free balance sheet. Q4 2024 saw a net income increase to $19.8 million from $13.0 million the previous year, driven by the strong performance of its core product, MACI. Sales surged 16% year-over-year to $75.4 million, with MACI contributing $68.3 million. While Epicel’s revenue declined slightly, NexoBrid’s revenue doubled to $1 million, signaling early traction for this burn treatment product.

Equally impressive is Vericel’s margin expansion. The company’s gross profit rose to $58.5 million, representing 78% of revenue—up from 75% in Q4 2023. Operational efficiencies have allowed the company to manage costs effectively, keeping sales and marketing expenses in check while expanding product reach.

Product Expansion and Market Potential

vcel.com

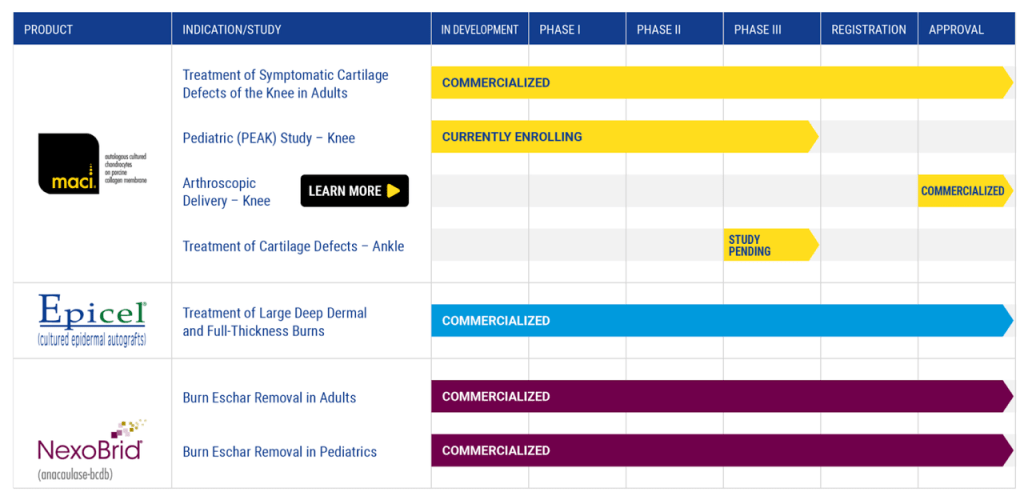

Vericel continues to dominate the autologous cartilage repair space with MACI, which is seeing increased adoption among orthopedic surgeons. Its expansion into ankle cartilage repair, with clinical trials set for 2025, could significantly widen its market reach. Epicel, Vericel’s permanent skin replacement for severe burns, remains a vital revenue contributor, though subject to hospital demand fluctuations. Meanwhile, NexoBrid, approved for eschar removal in burn patients, recently secured FDA clearance for a pediatric version, opening new commercial avenues.

Looking beyond its current offerings, Vericel’s pipeline reflects a calculated growth strategy focused on indication expansion rather than high-risk drug development. By broadening MACI’s applications and increasing market penetration, Vericel avoids the pitfalls of speculative biotech plays while driving sustainable growth.

Future Guidance and Market Outlook

Vericel projects revenue growth of 20-23% in 2025, a notable acceleration from the 16% achieved in 2024. This optimism stems from MACI’s continued adoption, Epicel’s stabilization, and NexoBrid’s gradual commercialization. The company anticipates gross margins between 73-74%, slightly lower than Q4’s 78%, due to increased investments in market expansion. However, adjusted EBITDA margins are expected to remain robust at 25-26%.

Long-term, Vericel aims for gross margins in the high 70% range and EBITDA margins in the high 30% range by 2029, reinforcing its trajectory toward becoming a larger healthcare player. Expansion into additional orthopedic and burn treatment markets could further accelerate growth.

Market Challenges and Competitive Risks

Despite its strengths, Vericel remains dependent on MACI’s success in cartilage repair, with competition from emerging regenerative therapies such as stem cell injections and platelet-rich plasma treatments. Any slowdown in MACI’s adoption due to reimbursement hurdles or changing surgical preferences could impact growth. Additionally, while NexoBrid has shown promising early sales, it remains an untested commercial asset that needs time to establish itself in the burn care market.

Another key challenge is pipeline diversification. While Vericel’s focused approach has driven profitability, its limited exposure beyond orthopedic and burn applications could pose a risk if market conditions shift. However, its calculated commercialization strategy mitigates this concern by prioritizing indication expansion over untested assets.

Valuation and Growth Potential

The U.S. cartilage repair market is substantial, with an estimated 200,000 to 300,000 procedures performed annually. At an average cost of $38,000-$45,000 per procedure, the total addressable market ranges from $7.6 billion to $13.5 billion. Vericel’s current revenue of $75.4 million represents a small fraction of this market, leaving significant room for expansion. Increased physician awareness, broader insurance coverage, and continued clinical validation could drive further penetration and revenue growth.

Key Takeaways

Vericel’s strategy of leveraging FDA-approved products, expanding indications, and maintaining financial discipline positions it for long-term success. With the upcoming launch of MACI for ankle cartilage repair and a strong balance sheet, the company is well-prepared to capitalize on new market opportunities. While challenges exist, its focus on sustainable growth rather than high-risk drug development reduces vulnerability to industry volatility. If management executes its long-term targets, Vericel could transition from a niche biotech firm to a major player in regenerative medicine.

Original article can be found here.

Leave a comment