If the last decade of biofabrication was defined by technical possibility, 2025 was the year the business reality became unavoidable.

Across funding announcements, platform launches, government contracts, and quiet shutdowns, one message became clear: biofabrication is no longer judged by what it can build, but by what it can sell, scale, and sustain.

This year, Business of Biofabrication focused less on speculative futures and more on the economic infrastructure forming underneath the field. Below is the distilled thesis of 2025.

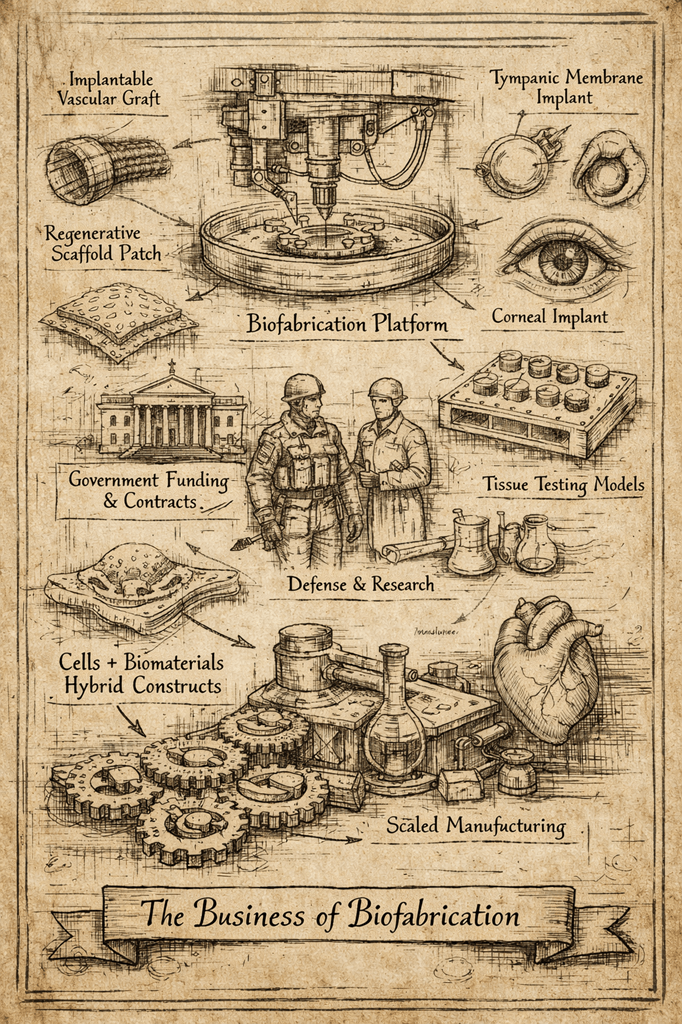

From “Printing Organs” to Building Assets

One of the clearest shifts in 2025 was the move away from headline-driven narratives (“printed hearts,” “biofabricated organs”) toward asset-oriented development.

The most credible companies are no longer promising full organs; they are building:

- Implantable subcomponents

- Regenerative patches

- Early-cannulation grafts

- Corneal, tympanic, or craniofacial implants

- Human tissue platforms for drug testing

The winners understand that regulatory pathways, reimbursement codes, and manufacturing repeatability matter more than visual spectacle. Biofabrication is maturing into a means, not a product category.

Platforms Are Quietly Winning

2025 also reinforced that platform companies outperform single-asset moonshots.

Whether in:

- Perfused tissue systems

- Human donor–derived testing platforms

- Modular biofabrication toolchains

- Materials + process stacks

The strongest businesses are those that generate revenue before clinical approval.

Government contracts, CRO-style services, and internal asset validation have become the preferred financing bridges between seed and Series A. This mirrors what happened earlier in genomics and cell therapy: infrastructure comes first, cures later.

The Government Is the Real Early Customer

One of the most underappreciated stories of 2025 is how dominant non-dilutive capital has become in shaping the biofabrication ecosystem.

SBIRs, OTAs, defense health programs, and federal procurement are no longer “nice to have.” They are:

- Signaling mechanisms

- Validation tools

- De-risking instruments

- Sometimes larger than venture rounds

Several of the most credible biofabrication companies in 2025 are government-backed before they are VC-backed. This is not a weakness — it is a reflection of how capital-intensive, regulated biology actually scales.

Cell-Only Is Not Enough

Another recurring theme this year was the convergence of cells, materials, and manufacturing.

Pure cell therapies face:

- Cost challenges

- Logistics complexity

- Reimbursement friction

- Immune barriers

The most compelling approaches combine:

- Living cells where they add value

- Structural materials where reliability matters

- Manufacturing processes designed for scale from day one

Biofabrication is becoming less about novelty and more about hybrid engineering discipline.

Valuation Reality Set In

2025 was also a year of correction.

- Hardware-only companies struggled unless paired with consumables or services

- Overfunded platforms were forced to narrow scope

- “Pre-revenue for 10 years” narratives stopped working

- Strategic acquirers became more selective, not more aggressive

The companies that survived — and in some cases thrived — were those that could clearly answer:

Who pays, how soon, and for what exactly?

What Biofabrication Is Actually Becoming

By the end of 2025, biofabrication no longer looked like a single industry. It looked like an enabling layer across multiple markets:

- Medical devices

- Drug development

- Advanced biomaterials

- Research infrastructure

- Regenerative manufacturing

This is why Business of Biofabrication exists: not to chase hype, but to map where value is actually accruing.

Looking Ahead

If 2025 was the year of realism, 2026 will be the year of selection.

Some platforms will harden into durable businesses. Others will quietly disappear. The winners will not be the loudest — they will be the ones who understand biology, regulation, capital, and manufacturing as a single system.

That is the business of biofabrication.

Leave a comment